Why Bitcoin Lightning Network is the Future of Payments

Explore why the Bitcoin Lightning Network is pivotal for the future of digital payments—addressing scalability, speed, and cost issues, revolutionizing how we transact.

•

7 min read

The world of digital payments is advancing quickly. The Bitcoin Lightning Network (LN) is touted to be at the forefront of this transformation, aiming to solve critical issues like scalability, transaction speed, and costs that have plagued Bitcoin since its inception.

Challenges of Modern Payment Systems

Today's payment systems grapple with several challenges, including high fees, slow transaction times, and scalability issues. Bitcoin, the world’s pioneering cryptocurrency, was not immune to these problems, especially as its popularity soared. The blockchain technology underlying Bitcoin ensures security and transparency but at the cost of transaction efficiency. This inefficiency becomes a bottleneck as the network grows, leading to higher fees and slower transaction times.

In addition, a critical aspect often overlooked in the banking sector is the settlement process. This process doesn't involve the physical movement of money — it's merely an adjustment of virtual balances within and between banks. Consequently, processes like SWIFT, which facilitate international bank transfers, can take several days to complete a transfer. This duration, combined with the fees charged by correspondent banks for facilitating these cross-border transactions, exemplifies the inefficiencies in the traditional financial system.

What is Lightning Network?

The Bitcoin Lightning Network is a "second layer" payment protocol designed to facilitate instant transactions at a fraction of the cost. By creating a network of payment channels that operate off the main blockchain, the LN enables users to conduct numerous transactions without needing to record each one on the Bitcoin blockchain. This mechanism significantly reduces the strain on the network, allowing for faster and cheaper transactions.

History and Evolution

The Lightning Network's journey began with a whitepaper in 2016 by Joseph Poon and Thaddeus Dryja. Titled "The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments," the whitepaper proposed a scalable Layer 2 solution to enable millions of transactions per second on the Bitcoin network. This groundbreaking idea was first put into practice with a working prototype presented at the Scaling Bitcoin conference in Milan later that year, marking the start of an ambitious project to overcome Bitcoin's scalability challenge.

By 2018, the first mainnet-ready beta implementation of the Lightning Network was released, marking the start of a new era for Bitcoin transactions. The network experienced remarkable growth in 2018 and 2019, as it began to attract wider attention and adoption, with both the number of nodes and channels reaching their peak in the first half of 2022.

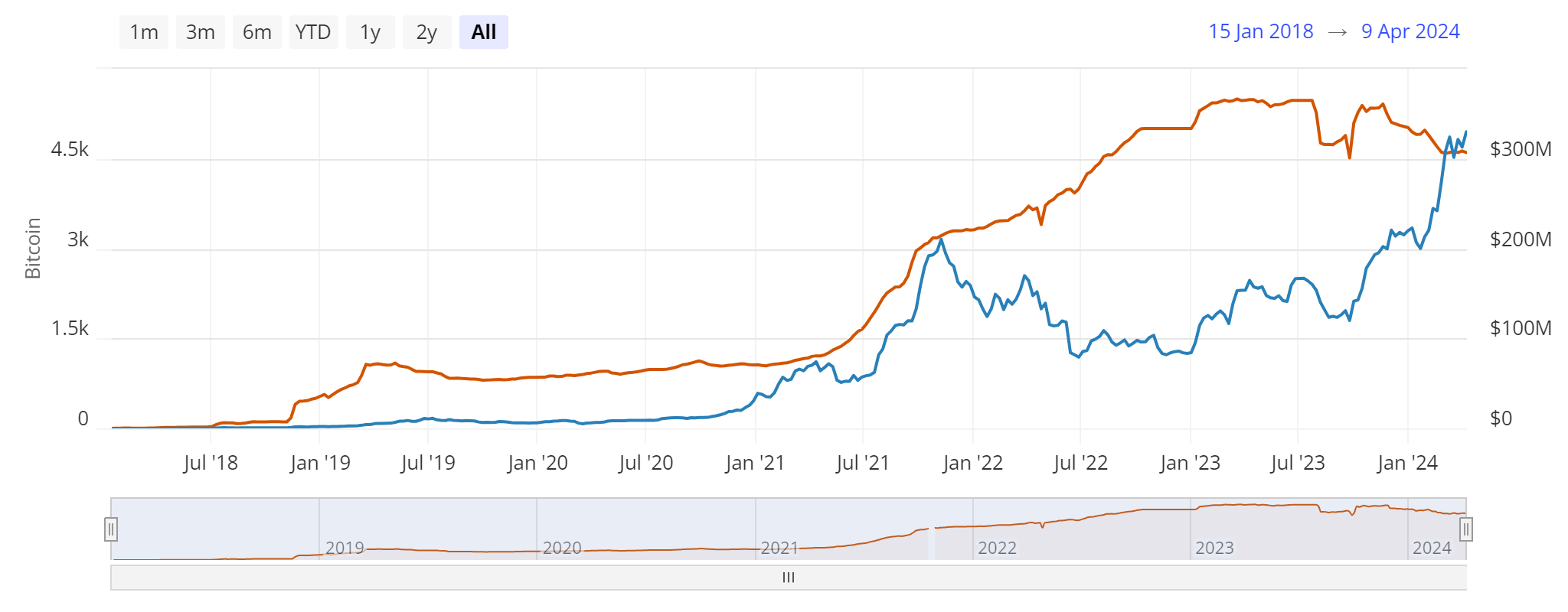

Although the number of nodes and channels may seem to have plateaued since then, hinting at a potential stagnation in adoption, the capacity of the Lightning Network has, in fact, more than tripled in the past three years, from 1,200 BTC to 4,600 BTC. Furthermore, when measured in USD, the capacity of the Lightning Network has soared beyond the record $300 million as of early April 2024, a surge largely attributed to the most recent Bitcoin rally.

Lightning Network Capacity. Source: Bitcoin Visuals

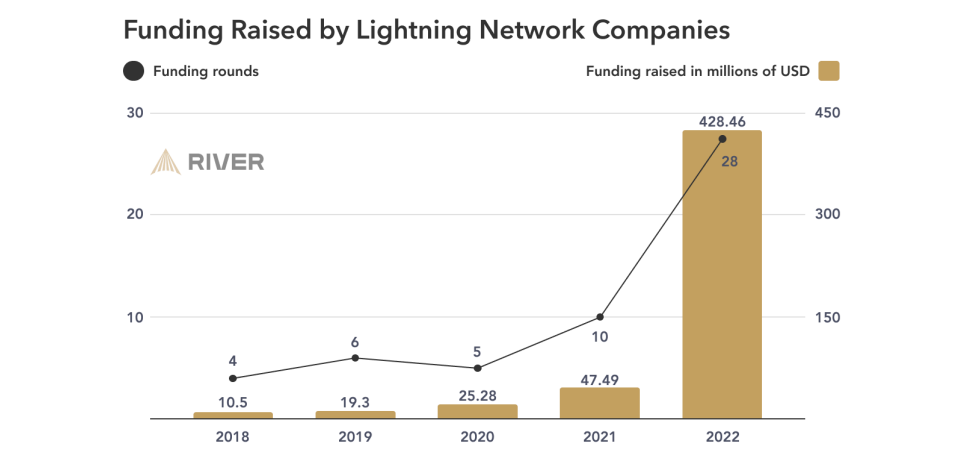

Industry Participation and Funding

An October 2023 report by River Financial provides an overview of the industry participation in the Lightning Network, mapping out 179 companies across 28 categories. Additionally, it highlights the financial investments into the ecosystem, with $530.93 million raised by 39 Lightning companies between 2018 and the end of 2022, of which $428.46 million was raised in 2022 alone. This significant funding year for Lightning came even as global venture capital investments saw a decrease.

Stroom Network followed suit in 2023, raising $3.5 million for the development of a Bitcoin liquid staking protocol, which seeks to contribute to the overall growth of the Lightning Network.

To sum things up, growth in transaction count, volume, and solutions built on the Lightning Network is clear, refuting the notion that "nobody is using Lightning" and instead showing a trend of tremendous growth in activity.

Benefits of the Bitcoin Lightning Network for Future Payments

The potential of the Lightning Network to revolutionize payments lies in its ability to address the inherent limitations of the Bitcoin network. Studies have demonstrated that the adoption of the Lightning Network is associated with reduced blockchain congestion, suggesting improvements in the efficiency of Bitcoin as a payment means.

Furthermore, the network's structure facilitates efficient, secure, and private routing of payments across the entire system, enabling anyone to transmit payments quickly and privately.

This is especially beneficial for e-commerce, where quick and cost-effective payment solutions are essential — leveraging the Lightning Network can provide merchants with a competitive edge.

Below are key benefits of the Lightning Network that underscore its potential to reshape future payments:

Scalability

The original Bitcoin blockchain faces a scalability problem, limiting its transaction processing capacity to an estimated range between 3.3 and 7 transactions per second (TPS) due to the block creation time and block size limit. This constraint significantly hinders its capacity to serve as a mass-scale payment system. In contrast, centralized payment systems like Visa and MasterCard can handle thousands of transactions per second, underscoring a substantial disparity in transaction throughput between decentralized and centralized payment networks.

Although there is no consensus on the exact number of transactions per second that the LN can process, theoretical estimates suggest that the potential transaction throughput ranges from 100,000 to 1 million TPS.

Instant Transactions

Traditional Bitcoin transactions require confirmation by miners, which can take time and leads to unpredictable transaction times. The Lightning Network enables near-instantaneous transactions by establishing direct channels between users for as long as needed. This feature is particularly advantageous for e-commerce, where fast and reliable transactions are crucial.

Reduced Transaction Fees

By moving transactions off the main blockchain, the Lightning Network circumvents the high fees associated with Bitcoin transactions during periods of congestion. This reduction in transaction costs makes microtransactions feasible, opening up new use cases for Bitcoin in micropayment environments such as online content monetization.

Increased Privacy

Transactions conducted over the Lightning Network can offer enhanced privacy compared to traditional Bitcoin transactions. Since transactions occur off-chain and only those associated with opening and closing channels are recorded on the blockchain, there's less publicly available information on the specifics of each transaction.

Enhanced Security

Despite operating off the main Bitcoin blockchain, the Lightning Network does not compromise on security. It employs smart contract functionality to ensure that transactions are secure and participants can only spend their funds according to the network's rules.

Global Financial Inclusion

Beyond immediate transactional benefits, the Lightning Network has the potential to contribute significantly to global financial inclusion. By lowering the barriers to entry for Bitcoin transactions through reduced costs and improved accessibility, it opens up possibilities for unbanked and underbanked populations to participate in the global economy.

E-Commerce Benefits

For e-commerce businesses, integrating the Lightning Network means access to a global customer base with the ability to process payments instantly and at a lower cost. This efficiency can provide a competitive advantage in the rapidly evolving digital marketplace.

Lightning Network’s Challenges and Limitations

Like any technological innovation, the Lightning Network has its own set of challenges and limitations that need addressing to fully harness its potential. Here, we delve deeper into some of the network's shortcomings, and how emerging solutions, like the Stroom Network, aim to address these challenges.

Complexity and User Experience

The requirement for users to manage channels and ensure nodes are online to receive payments adds complexity, potentially detracting from the user experience.

Centralization Concerns

There's a risk of increasing centralization within the network, as larger nodes with more capital and connections become key hubs. This could concentrate control and introduce vulnerabilities.

Liquidity Issues

A significant challenge within the Lightning Network is ensuring sufficient liquidity in payment channels to facilitate transactions. This can also lead to routing issues and impact the network's overall efficiency.

Stroom Network's approach to mitigating these challenges is multi-faceted. We operate a well-resourced and extensively connected Lightning node, employing proprietary algorithms for the meticulous management of channels and liquidity. By doing so, Stroom alleviates the technical complexities and financial commitments (such as the requirement to lock in Bitcoin) associated with operating a personal routing node on the Lightning Network.

Additionally, Stroom Network removes barriers for users by negating the necessity for individuals to self-host routing nodes and allocate Bitcoin as collateral within the network.

This strategy ensures that Stroom acts as a capital-efficient and dependable routing hub within the network. Furthermore, this innovative integration not only enhances the functionality of the Lightning Network, but also opens avenues for users to engage in liquid staking within DeFi ecosystems compatible with Ethereum Virtual Machine (EVM), offering a truly unique experience and greater financial opportunities.

What is the Future of the Bitcoin Lightning Network?

The future of the Bitcoin Lightning Network holds significant promise for transforming digital transactions, enabling Bitcoin to be used more effectively for everyday purchases and microtransactions due to its low fees and instant settlement capabilities.

Innovations such as multi-path payments and improvements in routing efficiency aim to address the current limitations and increase the network's robustness and privacy. As the network matures, it is expected to become more accessible and user-friendly, encouraging wider adoption and integration into existing payment systems.

One can also anticipate the emergence of new applications that leverage LN’s capabilities for instant payments, such as seamless micropayment solutions for online content creators, IoT transactions, and innovative financial services that were previously not feasible due to transaction cost and speed constraints. Furthermore, the integration of smart contract functionality could enable complex, automated transactions, opening up a plethora of possibilities for decentralized applications and services.

Additionally, the network could evolve to support more advanced types of financial instruments and services, further blurring the lines between traditional financial systems and the burgeoning world of cryptocurrencies.

Conclusion

The Lightning Network's potential to revolutionize payments lies in its varied approach to solving Bitcoin's limitations. By offering scalable, instant, and cost-effective transactions, it not only enhances Bitcoin's utility as a digital currency but also carves out new paths for its adoption across various sectors, including e-commerce, content creation, and beyond. Its development and adoption are critical steps towards realizing the vision of Bitcoin as a truly global, accessible, and efficient means of payment.

Stroom DAO

View our other posts

Bitcoin Without Borders: Unlocking Bitcoin's Multi-Chain Potential

Since the birthday of the first Bitcoin block on January 3, 2009, a new era of financial assets has begun - the cryptocurrency era. Unmatched security, permissionlessness, and decentralization cemented Bitcoin'

Stroom DAO

Lightning Network in 2025: Bitcoin’s Transformation into Everyday Money

Bitcoin’s Lightning Network is transforming from an experiment into a global payment system, making everyday transactions faster and cheaper.

Stroom DAO

Lightning Network: Celebrating 9 Years of Innovation

The Lightning Network whitepaper was unveiled on January 14, 2016, introducing a transformative layer atop Bitcoin for instant, scalable transactions.

Stroom DAO