Unlocking the Future of Lightning Network Liquidity

Exploring the vital role of liquidity with the Lightning Network and how Stroom approaches existing bottlenecks.

•

4 min read

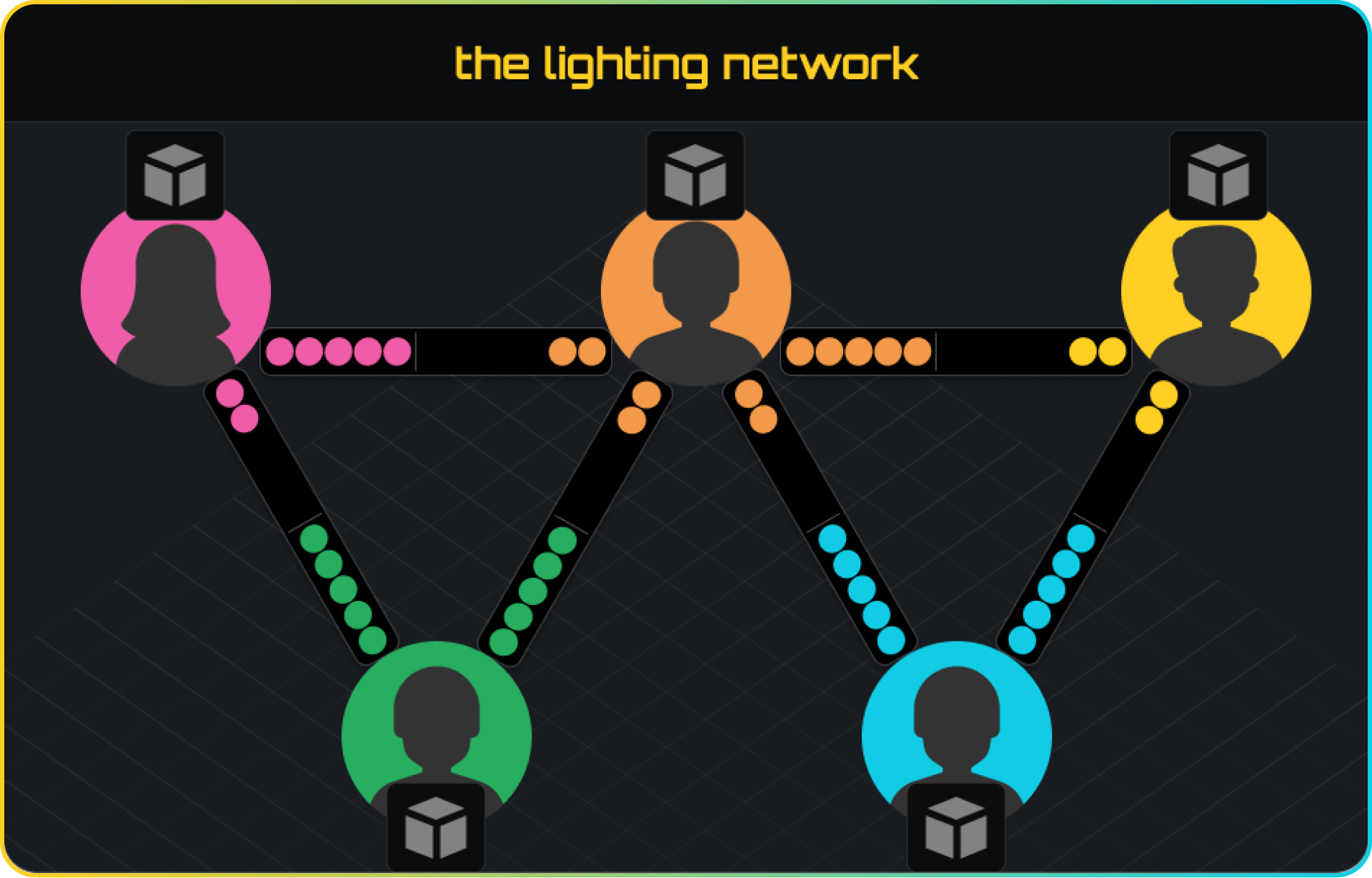

The Lightning Network represents a significant leap forward in the scalability and speed of cryptocurrency transactions, particularly for Bitcoin. As a layer atop the Bitcoin blockchain, it enables faster and cheaper transactions by allowing users to create payment channels between any two parties on that extra layer. This article delves into the crucial role of liquidity in such networks and how innovations are paving the way for a more robust and efficient system.

Addressing Liquidity Challenges in the Lightning Network

Liquidity is the lifeblood of the Lightning Network, determining the ease and efficiency with which transactions can occur. However, liquidity distribution is not always optimal, leading to potential bottlenecks.

In an ideal scenario, funds would be evenly distributed across all channels and nodes, allowing for seamless transactions at any time. However, the reality is often different. Some channels might become overfunded on one end while others might lack sufficient funds, leading to a situation where certain paths cannot complete a transaction. This uneven distribution can lead to a number of undesired scenarios, including delayed transactions, increased fees, and channel closures.

Such scenarios may occur if a preferred route lacks sufficient liquidity, meaning the network must find an alternate path, potentially leading to delays. Nodes might also charge higher fees for routing transactions through well-funded channels, thus increasing the overall cost of transactions. Additionally, participants might close and reopen channels to rebalance, which can be costly and time-consuming.

The implications of liquidity challenges extend beyond mere inconvenience. They can impact user confidence, network growth, and the overall perception of the Lightning Network as a viable scaling solution.

Innovative Solutions for Lightning Network Scaling

As the demand for faster and more efficient blockchain transactions increases, so does the need for innovative solutions that can address the inherent limitations of networks like Bitcoin. This is where Stroom Network steps in, leveraging liquid staking to enhance both liquidity and scalability of the Lightning Network.

We at Stroom firmly believe that for the Lightning Network to sustain its growth and utility, it must overcome the bottlenecks associated with channel funding and liquidity. Stroom's approach focuses on not just providing a band-aid solution but enhancing the fundamental infrastructure to support a larger volume of transactions and users.

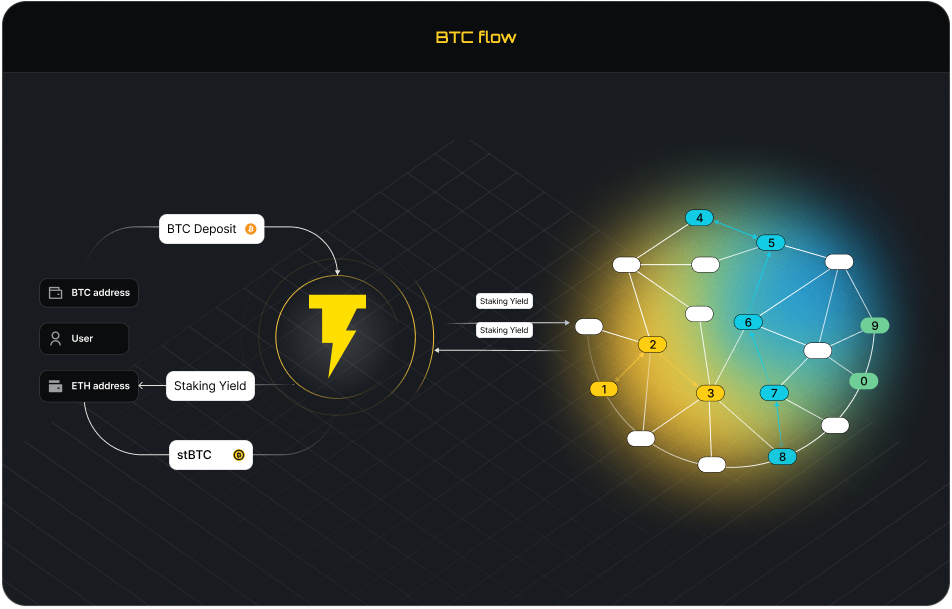

Here's how how Stroom’s liquid staking feature works:

Bitcoin Deposit: Users start by depositing their Bitcoin into the Stroom’s treasury.

Minting tokens: Upon depositing BTC into the Stroom DAO treasury, you can mint either stBTC or bstBTC—liquid ERC-20 tokens that can be used across DeFi platforms.

While stBTC maintains a 1:1 ratio with Bitcoin, bstBTC operates with a fluctuating rate, providing users with a unique opportunity to earn yield in native Bitcoin. There's also the freedom to convert both stBTC and bstBTC back to BTC at any moment.

Stroom DAO Operations: The Stroom DAO manages the intricacies of processing the Bitcoin deposits into LN channels. It's responsible for the strategic opening and maintenance of channels, ensuring optimal liquidity distribution throughout the network.

Distribution of Rewards: Users earn rewards based on their participation and contribution to the network's liquidity.

Stroom's innovative approach and robust technological framework collectively contribute to a more scalable and liquid Lightning Network, resulting in a smoother transaction experience for all participants, enhanced network capacity, and a more resilient and decentralized network structure.

Understanding Stroom’s Liquid Staking Rewards

The reward system within Stroom is intricately linked to the operations of the Lightning Network. By aiding in and supporting LN transactions, users gather a portion of the transaction fees as rewards. These rewards are then issued in the form of bstBTC, fostering a cycle where active participation leads to rewards.

Furthermore, engaging in liquid staking through Stroom allows your assets to stay liquid, thereby optimizing the use of your capital. This benefit stems from the possibility for users to participate in a wide range of DeFi activities. These include lending, borrowing, and trading on decentralized exchanges (DEXs), all without the need to lock up their assets.

Bridging Bitcoin to DeFi: Stroom Network's Integration with Ethereum

The Stroom Network's integration with Ethereum represents a significant stride in bridging the gap between Bitcoin's Lightning Network and the broader DeFi space. This intersection offers users new avenues for passive income while enhancing the utility and reach of the broader cryptocurrency ecosystem.

Our belief is that the future lies in more interconnected and versatile blockchain networks. Thus, integrating Stroom with Ethereum's DeFi ecosystem represents not just a technical achievement but a step toward that future as it allows for the fluid movement of value between networks, while providing users with a richer, more diversified experience.

Stroom’s Future Vision

Stroom's integration with the Lightning Network and DeFi ecosystems is a strategic endeavor aimed at enhancing the network's stability and reliability. We expect it will catalyze increased usage of the Lightning Network, potentially leading to a beneficial cycle of higher activity and more attractive Annual Percentage Rates (APR) for participants.

The ultimate goal is to create a more robust and efficient network that serves its users more effectively, fostering a healthier ecosystem where the Lightning Network's reliability is matched by its utility.

As the cryptocurrency sector continues to evolve, we believe that such integrations will likely play a crucial role in shaping the future of blockchain technology and finance.

The confidence in Stroom's innovative approach was underscored in the summer of 2023 when we raised $3.5 million in an oversubscribed seed funding round led by prominent players, such as Greenfield Ventures and Ankr, among others. This funding not only provides the necessary capital to propel Stroom forward but also reflects a strong belief in our potential to impact the evolution of DeFi and Bitcoin spaces.

If you're intrigued by the potential of enhancing your participation in the cryptocurrency space, or simply curious about the innovative solutions offered by Stroom, consider delving deeper into our services.

To learn more about Stroom, access detailed information about our technology, or explore how you can join the ecosystem, visit the following resources:

Official website: https://stroom.network/

Whitepaper: https://stroom.network/Primer.pdf

Twitter (X): https://twitter.com/StroomNetwork

Discord: https://discord.gg/DZ53WjDXz9

Telegram: https://t.me/stroomnetwork

Stroom DAO

View our other posts

Bitcoin Without Borders: Unlocking Bitcoin's Multi-Chain Potential

Since the birthday of the first Bitcoin block on January 3, 2009, a new era of financial assets has begun - the cryptocurrency era. Unmatched security, permissionlessness, and decentralization cemented Bitcoin'

Stroom DAO

Lightning Network in 2025: Bitcoin’s Transformation into Everyday Money

Bitcoin’s Lightning Network is transforming from an experiment into a global payment system, making everyday transactions faster and cheaper.

Stroom DAO

Lightning Network: Celebrating 9 Years of Innovation

The Lightning Network whitepaper was unveiled on January 14, 2016, introducing a transformative layer atop Bitcoin for instant, scalable transactions.

Stroom DAO