Maximizing DeFi Earnings - Liquid (Re)Staking Explained

Discover how liquid staking and restaking can open up new earning opportunities in DeFi and where Stroom's Bitcoin liquid staking offering come into play.

•

11 min read

If you've been following the cryptocurrency space, you've probably heard of staking. It's a way to earn rewards by locking up your crypto assets to support a blockchain network's operations. But, there’s a catch—traditional staking often requires you to “lock” your assets for a set period, meaning you can’t touch or use them. That’s where liquid staking comes in, offering a more flexible solution, which lets you earn rewards without giving up access to your funds.

And now, liquid staking has evolved into liquid restaking, a more sophisticated strategy for maximizing returns that offers enhanced yield potential and capital efficiency while introducing new complexities and risks that participants must navigate carefully. But there's more: Bitcoin, traditionally not associated with staking, is getting its own liquid staking treatment through Stroom Network.

Let’s dive into how these mechanisms work, the advantages, the risks, and some of the top platforms offering liquid (re)staking.

What Is Liquid Staking and How Does It Work

In traditional staking, when you lock your tokens to help run a network, those tokens are temporarily off-limits. You earn rewards, but you can’t trade, sell, or use your tokens for anything else until the staking period is over.

Liquid staking changes that game. Instead of locking your tokens away, you stake them through a liquid staking service provider, and in return, you get a liquid staking token (LST). This LST is like a receipt that represents your staked tokens. The cool part? You can still use this LST to trade, lend, use as collateral, or participate in other decentralized finance (DeFi) activities—all while continuing to earn rewards on your staked tokens.

For example, let’s say you’re staking Ethereum (ETH) using a platform like Lido. You’d get stETH (staked ETH) in return. While your ETH continues to earn staking rewards, your stETH can be traded or used in other DeFi protocols to maximize your earnings.

Why Liquid Staking Is a Game-Changer

So, what makes liquid staking so appealing? Here are some of the standout benefits:

- Liquidity Freedom: You don’t have to worry about waiting for an unbonding period to access your funds. You can still trade or use your staked assets while they earn rewards.

- Earn More Rewards: Not only do you collect staking rewards, but by using your liquid staking token in DeFi, you can generate even more yield, literally getting several streams of income from the same asset.

- No Tech Hassles: Unless you opt for pooled staking platforms, traditional staking requires users to set up and maintain their own validator nodes, which involves software installation, server management, and network configuration. In contrast, liquid staking eliminates these requirements entirely. Users can simply deposit their tokens into a liquid staking platform without having to worry about the underlying technical complexities.

- Lower Barriers to Entry: Traditional staking can require a lot of tokens (e.g., for Ethereum staking there’s a hefty minimum requirement of 32 ETH, or staking in Lightning Network efficiently, you need at least 20 BTC estimated). With liquid staking platforms, you can stake smaller amounts, making it more accessible to everyday users.

The Risks and Challenges of Liquid Staking

Of course, no innovation comes without some drawbacks. Here are the main risks you should be aware of with liquid staking:

- Smart Contract Risks: Liquid staking relies on smart contracts, which are not foolproof. If there’s a vulnerability or bug, it could lead to losses, especially if hackers exploit it.

- Counterparty Risk: Some liquid staking platforms are centralized, which means you’re putting trust in the platform’s management and solvency. If the platform fails, your assets could be at risk. Decentralized alternatives help mitigate these risks, so users should carefully evaluate the type of platform they choose based on their risk tolerance, technical expertise, and desired level of control over their assets.

- Market Volatility: Just like the underlying crypto asset, the liquid staking token can fluctuate in value. So, during market downturns, your LST could lose value alongside your staked asset.

- Limited Governance Rights: When you use a liquid staking service, you might lose some say in network governance. If voting rights are important to you, liquid staking may reduce your ability to influence decisions on the blockchain network.

- Slashing risks: restaking comes with additional risks of assets being slashed in the process of validating multiple blockchain protocols and decentralized applications. Hence, additional rewards are given to stakers for taking higher slashing risks. However, if the validator behaves as intended, no slashing occurs.

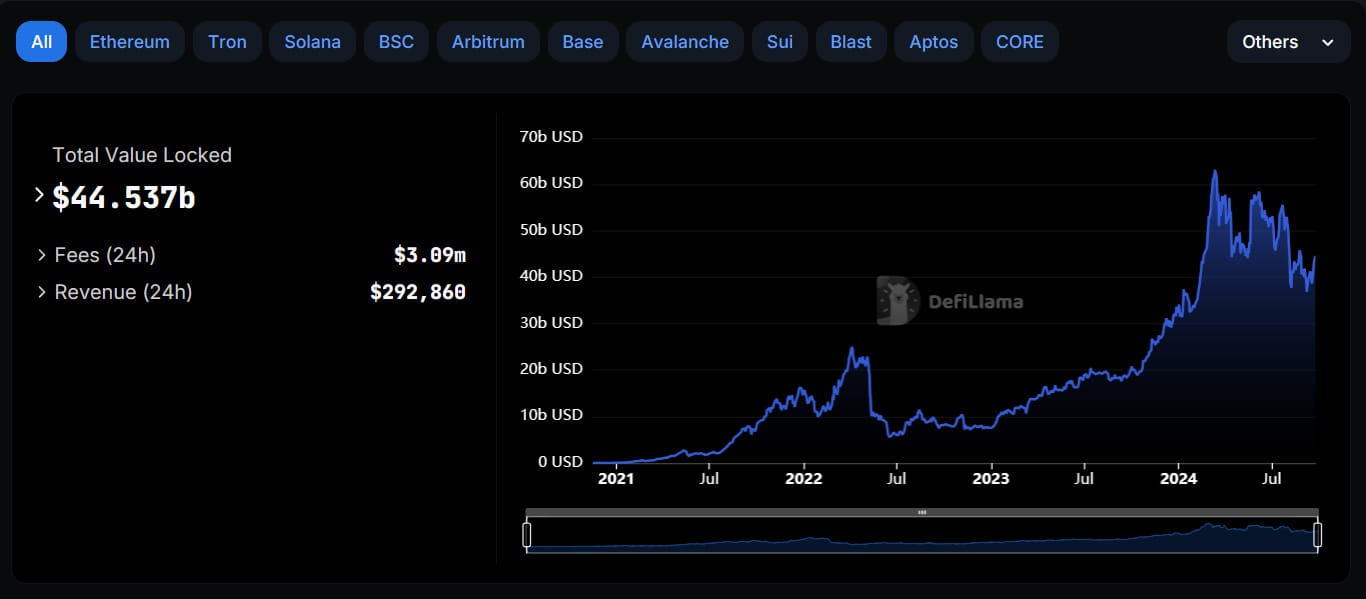

Current Market Overview

As of the end of September 2024, the liquid staking market has grown to an impressive $44.5 billion in total value locked (TVL). Lido Finance leads the pack, dominating with $25.7 billion in TVL, representing nearly 62% of the market. This shows just how popular and valuable liquid staking has become in the broader crypto space.

Top Liquid Staking Platforms to Explore

Several platforms have stepped up to offer liquid staking services, each with its unique features. Let’s take a look at some of the top contenders:

- Lido Finance: Lido is the leader in liquid staking, especially for Ethereum. When you stake ETH, you get stETH, which can be used across various DeFi platforms. Lido’s total value locked (TVL) is a whopping $25.7 billion, giving it a huge slice of the liquid staking market.

- Rocket Pool: Rocket Pool stands out for its decentralized approach. You can stake as little as 0.01 ETH and receive rETH in return. Rocket Pool is community-driven and has a TVL of around $3.3 billion. The current annual percentage rate (APR) for staking rETH is approximately 2.23%, and rETH can be utilized across various DeFi platforms like AAVE for liquidity or collateral while still generating rewards.

- Jito is a leading liquid staking platform on the Solana blockchain that integrates Maximum Extractable Value (MEV) rewards into its staking model. Users can stake their Solana (SOL) tokens and receive JitoSOL in return, which immediately begins accruing yield from both traditional staking rewards and additional MEV returns. With over 13 million SOL in total value locked (TVL), JitoSOL stands as the largest MEV-powered staking pool on Solana, offering a competitive 7.58% APY. The staking and unstaking processes are designed to be user-friendly, adhering to Solana's native timelines.

- Coinbase: Known for being beginner-friendly, Coinbase has cbETH, its own liquid staking option, mainly focused on Ethereum. With TVL over $500 million. cbETH integrates well with DeFi applications like Uniswap and Curve, allowing users to maximize yields without lockup constraints, while Coinbase's reputation as a publicly listed exchange and its security measures provide additional peace of mind for users.

- Frax Ether (Frax ETH) is a liquid staking derivative that is part of the Frax Finance ecosystem, designed to maximize staking yield and simplify the Ethereum staking process. When users stake Ethereum (ETH), they receive frxETH, a token that acts as a stablecoin loosely pegged to the value of ETH. Frax Ether has emerged as a notable player in the liquid staking market, currently boasting a total value locked (TVL) of approximately $480 million.

- Ankr: Ankr offers staking across multiple blockchains, like Ethereum, Binance Smart Chain, Avalanche, and Fantom. With a focus on security and decentralization, Ankr employs advanced measures to protect users' assets. Overall, Ankr provides a comprehensive solution for users looking to engage in staking while leveraging the benefits of DeFi for additional yield opportunities.

- Marinade Finance: For Solana users, Marinade offers liquid staking with mSOL. The platform has established itself as a key player in the Solana DeFi ecosystem, boasting a total value locked (TVL) of over $730 million. By staking with Marinade, users can take advantage of competitive yields, currently offering an annual percentage yield (APY) of approximately 7%.

Liquid Restaking: An Extra Layer of Earning Potential

While liquid staking is a powerful tool, liquid restaking offers an advanced strategy for those looking to maximize their crypto holdings’ earnings even further. Liquid restaking allows you to take the liquid staking token (LST) you received from staking and use it in a new layer of staking, creating a liquid restaking token (LRT). This LRT can then be deployed across multiple blockchain protocols and decentralized applications, thereby earning additional rewards.

How Liquid Restaking Works

- Initial Staking: You stake your cryptocurrency (like Ethereum or Bitcoin) and receive a liquid staking token as proof of your staked assets.

- Restaking: You then take your LST and deposit it into a liquid restaking protocol, such as EigenLayer for stETH, or Symbiotic for stBTC. In return, you receive a liquid restaking token.

- Dual Utility: The LRT can be used to secure additional blockchain protocols or applications known as Actively Validated Services (AVSs), while still accruing rewards from the original staking activity.

Essentially, liquid restaking allows you to stack multiple layers of rewards on top of your initial stake, significantly enhancing the yield potential of your assets.

Key Benefits of Liquid Restaking

- Enhanced Yield Potential: Earn rewards from multiple sources simultaneously, boosting your overall returns.

- Capital Efficiency: Maximize the use of your staked assets across various platforms without needing to unstake them.

- Diversification: Spread your risk by participating in multiple DeFi applications and protocols.

Risks and Considerations

While the potential benefits are compelling, it's important to be aware of the associated risks:

- Smart Contract Risks: Both liquid staking and restaking rely heavily on smart contracts, which can be vulnerable to bugs or exploits.

- Market Volatility: The value of LSTs and LRTs can fluctuate, potentially leading to losses if market conditions worsen.

- Slashing Risks: In restaking, if a validator misbehaves or is penalized, it could lead to slashing, impacting your staked assets. Slashing risks in restaking are higher than in traditional staking, since assets are used to validate multiple blockchain protocols and decentralized applications. However, for (re)stakers taking higher risks leads to higher rewards. Note that if the validator behaves as intended, no slashing occurs.

- Liquidity Constraints: During adverse market conditions, you may find it challenging to liquidate your positions quickly without incurring losses. But in general, all LSTs or LRTs are convertible to the base asset with some delay. In Stroom, we try to keep the unbounding period as short as possible, making it comparable to several Bitcoin block times in most cases.

Liquid Staking vs Liquid Restaking

Although both liquid staking and liquid restaking provide enhanced flexibility and earning potential compared to traditional staking, they serve different purposes:

| Feature | Liquid Staking | Liquid Restaking |

|---|---|---|

| Purpose | Provides liquidity while earning staking rewards | Amplifies yield by utilizing LSTs in additional staking layers |

| Token Type | Liquid Staking Token (LST) | Liquid Restaking Token (LRT) |

| Complexity | Relatively straightforward | More complex, with additional smart contract risks |

| Risk Level | Moderate, linked to smart contracts and LST value; potential slashing | Higher, due to multiple layers of staking and potential slashing |

| Yield Opportunities | Earn from staking and DeFi | Earn from staking, restaking, and DeFi |

Current Market Overview

As of the end of September 2024, the liquid restaking market stood at over $11.5 billion in TVL. This emerging sector has seen significant growth, particularly driven by platforms utilizing restaking capabilities of EigenLayer—an innovative protocol that allows assets already staked on the Ethereum blockchain to be "restaked" to secure additional applications or services built on top of it, thereby enhancing both security and efficiency across the network.

Liquid Restaking Platforms to Watch

- Ether.Fi is a decentralized protocol that enhances Ethereum staking by allowing users to restake their LSTs while retaining control over their keys. The platform introduces a unique liquid staking token eETH, which enables users to earn rewards from both staking and restaking activities. While exact APR figures can fluctuate based on network conditions and the number of active validators, users can expect an APR that in the range of 5% to 7.5%, depending on market dynamics and the specific staking conditions at any given time. At the time of this writing, Ether.Fi boasts a TVL of approximately $5.8 billion.

- Puffer Finance is a decentralized native liquid restaking protocol built on EigenLayer, which allows participants to stake their ETH and receive a liquid staking token called pufETH. Puffer Financehas rapidly gained traction with a TVL of approximately $1.4 billion, providing users with competitive APR rates that can exceed 8% when combining Ethereum staking and restaking rewards.

- EigenPie, a SubDAO within the Magpie ecosystem, specializes in isolated liquid restaking. It currently has a TVL of about $1.2 billion. Users can deposit their LSTs, such as stETH and rETH, to receive LRTs that maintain liquidity and generate ongoing rewards. While the exact APR for EigenPie can vary depending on market conditions and specific staking parameters, thanks to its innovative yield-boosting mechanisms it typically offers competitive rates that can range from 5% to 10%.

- Renzo focuses on maximizing returns for stakers through its liquid restaking model. The platform has achieved a TVL of approximately $1 billion, offering an APR of around 3% for users who stake their ETH and utilize Renzo tokens—ezETH and pzETH—across various DeFi protocols for additional earnings.

- Mellow LRT Mellow Protocol is an innovative liquid restaking platform that empowers users to create and manage LRTs tailored to their individual risk profiles. While the exact APR for Mellow can vary based on market conditions and specific strategies employed within its vaults, users can generally expect rates starting from 4.3% and potentially higher, depending on the chosen strategy and underlying assets. Mellow LRT features a modular infrastructure designed for institutions and sophisticated risk curators, enabling them to issue and curate LRTs with diverse risk and yield profiles. optimize returns while managing risk effectively. The platform currently has a TVL of about $725 million.

Introducing Bitcoin Liquid Staking on Stroom Network

Stroom Network brings the concept of liquid staking to the Bitcoin ecosystem by utilizing the Lightning Network, a layer-2 scaling solution for Bitcoin that enables faster and cheaper transactions. Traditionally, Bitcoin hasn't been part of the staking conversation because it uses proof-of-work (PoW) instead of proof-of-stake (PoS). However, Stroom changes that by enabling Bitcoin holders to stake their BTC and receive liquid staking tokens called stBTC and bstBTC while maintaining liquidity.

Understanding How Stroom Network Operates

- Staking Bitcoin: Users can stake their BTC in Stroom’s protocol and receive stBTC or bstBTC tokens in return, which serve as a representation of their staked Bitcoin on the Lightning Network.

- Yield Generation: Holders of stBTC and bstBTC earn yield directly in Bitcoin through Lightning Network routing fees, allowing them to generate passive income on their staked assets.

- DeFi Integration: stBTC and bstBTC are wrapped on Ethereum, making them compatible with a variety of DeFi platforms. This means that users can utilize stBTC and bstBTC for lending, liquidity provision, or yield farming on platforms like Aave, Compound, or Uniswap, expanding their earning opportunities beyond traditional staking.

Step 1: Stake your BTC.

— Stroom (@StroomNetwork) August 26, 2024

Step 2: Receive stBTC.

Step 3: Earn daily LN routing fees & DeFi yield.

Stroom: The best of Bitcoin, Lightning Network & Ethereum ⚡️

stBTC and bstBTC Potential Use Cases

From a technical standpoint, both stBTC and bstBTC are designed to integrate effortlessly into the DeFi ecosystem as ERC-20 tokens, thanks to their compatibility with smart contracts and interoperability across Ethereum and other EVM (Ethereum Virtual Machine) networks. This means they can easily interact with existing DeFi platforms, opening up a wide range of potential use cases.

For example, stBTC and bstBTC can be used as collateral in lending protocols, allowing users to borrow other assets without having to sell their staked Bitcoin. They can also provide liquidity in decentralized exchanges, enabling holders to earn trading fees while still receiving staking rewards.

When it comes to liquid staking, these tokens offer Stroom holders the flexibility to choose the best strategy for maximizing returns while their staked BTC continues to earn rewards.

In the case of liquid restaking and Stroom’s partnership with Symbiotic, stBTC and bstBTC go even further, enabling users to stake their tokens in multiple layers and secure additional blockchain services, which can generate rewards in various cryptocurrencies. This versatility makes stBTC and bstBTC powerful tools for boosting returns and improving capital efficiency in the DeFi space.

Read more about the potential use cases for Stroom Network’s token in our earlier blog article.

*****

We trust you've found this article helpful. To learn more about Stroom, access detailed information about our technology, or explore how you can join the ecosystem, visit the following resources:

Official website: https://stroom.network/

Whitepaper: https://stroom.network/Primer.pdf

Twitter (X): https://x.com/StroomNetwork

Discord: https://discord.gg/DZ53WjDXz9

Telegram: https://t.me/stroomnetwork

Stroom DAO

View our other posts

Bitcoin Without Borders: Unlocking Bitcoin's Multi-Chain Potential

Since the birthday of the first Bitcoin block on January 3, 2009, a new era of financial assets has begun - the cryptocurrency era. Unmatched security, permissionlessness, and decentralization cemented Bitcoin'

Stroom DAO

Lightning Network in 2025: Bitcoin’s Transformation into Everyday Money

Bitcoin’s Lightning Network is transforming from an experiment into a global payment system, making everyday transactions faster and cheaper.

Stroom DAO

Lightning Network: Celebrating 9 Years of Innovation

The Lightning Network whitepaper was unveiled on January 14, 2016, introducing a transformative layer atop Bitcoin for instant, scalable transactions.

Stroom DAO