Mapping Lightning Network - Scaling Bitcoin for Global Payments

Explore a detailed map of the Lightning Network ecosystem—key tools, wallets, and innovations driving faster, cheaper, and scalable Bitcoin payments worldwide.

•

11 min read

Bitcoin revolutionized the world as the pioneering decentralized digital currency, but as its popularity soared, so did its limitations. High fees and slow transaction times raised doubts about its ability to scale for global adoption.

The Lightning Network emerged as a breakthrough solution—a second-layer protocol built on Bitcoin to enable faster, cheaper, and scalable payments. Instead of processing every transaction directly on the blockchain, it uses off-chain payment channels to handle transactions almost instantly, while settling final balances securely on Bitcoin’s main chain.

This approach transforms Bitcoin into a high-speed payment network, unlocking microtransactions and enabling new possibilities for commerce, remittances, and financial innovation. Whether it’s buying a coffee, tipping online creators, or transferring value across borders, the Lightning Network brings Bitcoin closer to fulfilling the original vision as a global, peer-to-peer payment system.

Why Does Scalability Matter?

Bitcoin’s design prioritizes security and decentralization, but this focus comes at the expense of scalability. With the ability to process only 7 transactions per second (TPS), Bitcoin’s main network struggles to meet the demands of a world accustomed to the lightning-fast speeds of systems like Visa, which handles up to 65,000 TPS. In contrast, the Lightning Network can theoretically scale to millions of TPS, making it capable of supporting global payments and micropayments with ease.

This limitation raises critical questions:

- Can Bitcoin handle everyday purchases, from a cup of coffee to online subscriptions?

- Will it ever rival bank transfers or remittance services like Western Union?

- How does it address the need for global micropayments in a digital economy?

The Lightning Network answers these challenges by introducing a second layer that processes transactions off-chain, dramatically improving speed and reducing costs. It effectively enables instant payments by eliminating the need to wait for block confirmations. Transactions settle in milliseconds, making it suitable for point-of-sale systems and e-commerce platforms where speed is critical.

LN’s design significantly reduces transaction fees, often to fractions of a cent, which opens the door for microtransactions—a feature particularly useful for use cases like streaming payments and online tipping.

Another advantage is enhanced privacy. Since most transactions occur off-chain, only the final balances are recorded on the Bitcoin blockchain. This structure reduces on-chain data exposure, adding a layer of confidentiality to Lightning payments.

However, despite its promise, the Lightning Network has faced its share of criticisms and doubts. Skeptics point to issues like channel liquidity constraints, which can sometimes make payments unreliable, especially over longer routes. Others highlight custodial risks, as many wallets and services rely on centralized infrastructure to improve user experience, potentially compromising Bitcoin’s decentralized ethos.

Yet, as adoption grows and technology improves, these concerns are gradually being addressed. Innovations in channel management and liquidity markets are tackling reliability challenges, while non-custodial wallets and self-hosted solutions are empowering users to take full control of their funds. Despite its imperfections, the Lightning Network represents a giant leap forward in scaling Bitcoin and making it more practical for everyday use.

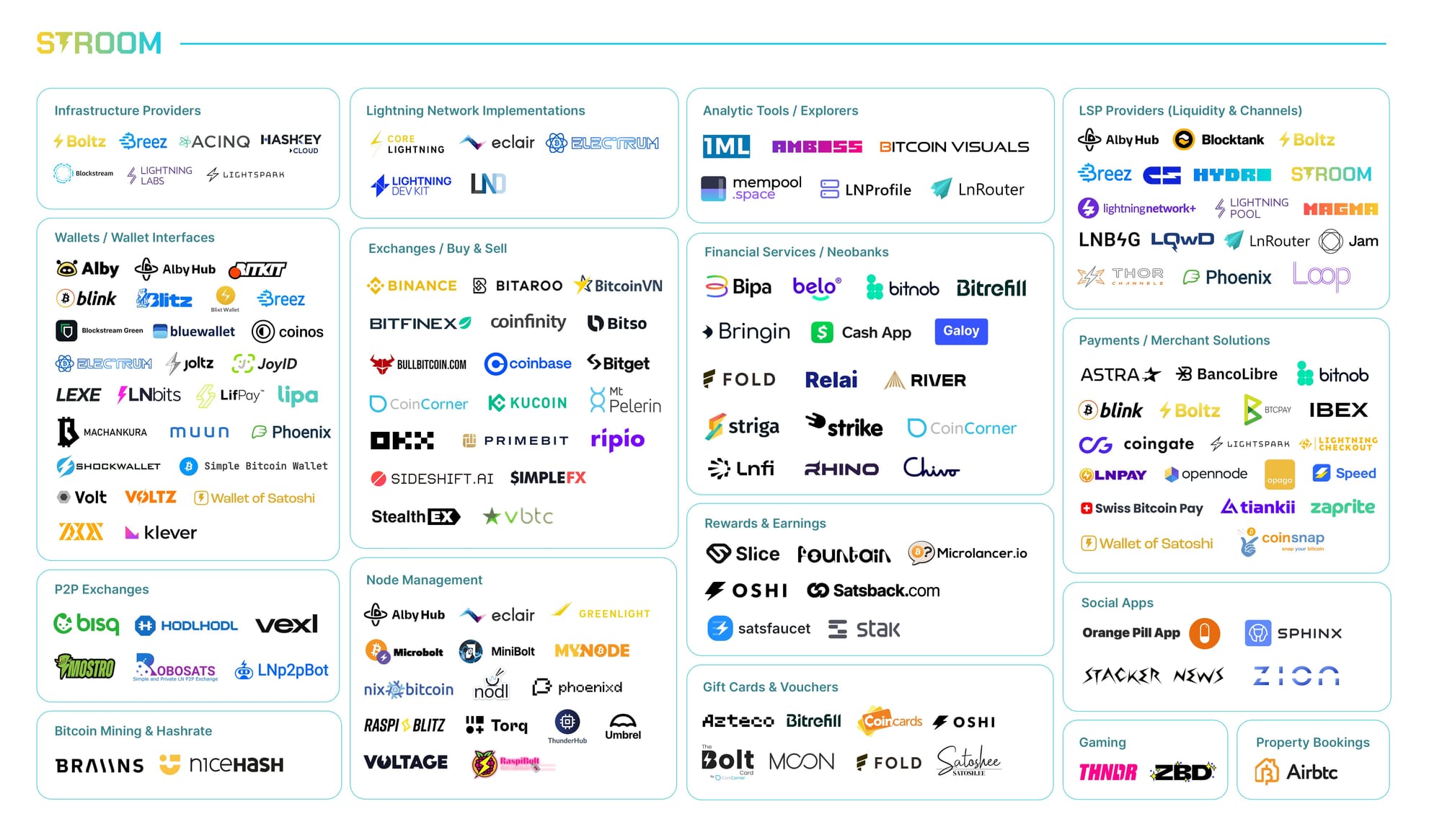

Key Players

Since its launch in 2018, the Lightning Network has seen significant growth, crossing over 5,000 BTC in liquidity and 19,000+ public nodes as of 2024. Key players such as Lightning Labs, Blockstream, BTCPay Server, ACINQ, and many more have driven innovation by developing cutting-edge tools, wallets, and payment solutions.

By the end of 2024, the Lightning Network ecosystem has matured into a diverse and robust infrastructure, supporting everything from payment processing to liquidity provisioning, analytics, and wallet interfaces.

While the map above highlights some of the most influential projects, it is by no means exhaustive—new tools and services continue to emerge almost daily, reflecting the rapid pace of innovation within the growing LN ecosystem.

Infrastructure Providers: Building the Backbone

Infrastructure providers form the foundation of the Lightning Network by developing and maintaining essential protocols, tools, and services.

- Lightning Labs – Creators of LND (Lightning Network Daemon), one of the most popular implementations.

- Blockstream – Developers of Core Lightning and Greenlight, focusing on scalability and developer-friendly tools.

- ACINQ – Builders of Eclair and the popular Phoenix Wallet for seamless Lightning payments.

- Lightspark – Provides enterprise-grade Lightning infrastructure for scalability and compliance.

- Breez – Focuses on integrating Lightning into consumer-facing apps and payment platforms.

Major Lightning Network Implementations

At the heart of the Lightning Network’s growth and functionality are several key implementations that provide the building blocks for payment channels, routing, and liquidity management. Each implementation caters to specific use cases, developer preferences, and performance requirements, ensuring the network remains flexible and scalable as adoption increases.

- Lightning Network Daemon (LND) – LND, created by Lightning Labs, is arguably the most widely used implementation of the Lightning Network. Known for its comprehensive feature set and strong developer support, LND powers numerous wallets, payment processors, and liquidity services. Its popularity stems from its ease of integration and extensive API support.

- Core Lightning (CLN) by Blockstream – Developed by Blockstream, Core Lightning (formerly c-lightning) is a modular and lightweight implementation designed for efficiency and flexibility. It’s highly customizable, making it a preferred choice for developers and enterprises looking to tailor their Lightning setups to specific needs. Its minimal resource requirements allow it to run seamlessly even on low-powered devices.

- Lightning Dev Kit (LDK) – LDK by Spiral (part of Block’s initiative, formerly Square) provides a developer-friendly toolkit for building custom Lightning applications. It prioritizes flexibility and allows developers to embed Lightning functionality into their own applications without requiring a complete node implementation.

- Eclair by ACINQ – ACINQ’s Eclair is one of the earliest implementations, focusing on developer tools and mobile applications. Eclair, which has recently rolled out its v0.11.0 update with the full support for Bolt 12, the newly accepted standard for Lightning Network offers, is widely regarded for its emphasis on stability and ease of use for end-users and developers alike.

- Electrum – Known primarily as one of the oldest and most trusted Bitcoin wallets, Electrum also supports Lightning payments through its integration with the network. It provides users with custodial control over their funds and is ideal for those who prefer a hybrid wallet experience combining both on-chain and Lightning transactions.

Liquidity Providers

Liquidity providers (LPs) play a crucial role in the efficient operation of the Lightning Network by facilitating connections between payment channels. They help maintain liquidity across the network, allowing users to execute transactions quickly and with minimal fees. By providing liquidity, LPs ensure that there are sufficient funds available in various channels, which enhances the overall performance and reliability of the network.

- Loop – Developed by Lightning Labs, Loop simplifies liquidity management for businesses and individual node operators. It allows users to rebalance payment channels seamlessly—either by pulling funds into channels (Loop In) or pushing funds out (Loop Out). This flexibility reduces the risk of channel depletion, ensuring payments flow without interruptions.

- Hydro – Hydro by Amboss is a peer-to-peer liquidity marketplace designed to help node operators find balanced channels without relying on custodial services. It enables users to rent liquidity and participate in dynamic liquidity auctions, fostering a decentralized market for routing optimization.

- Boltz – Boltz offers non-custodial atomic swaps between Bitcoin’s on-chain and Lightning Network. It allows users to open and close channels seamlessly, enabling trustless liquidity provisioning without relying on intermediaries. Boltz also supports cross-chain swaps, further enhancing its utility for multi-chain environments.

- Lightning Pool – A liquidity marketplace that connects buyers and sellers of liquidity through dynamic pricing mechanisms. It helps users open channels with pre-funded liquidity, enabling them to participate in the network without the complexity of manual channel management.

Wallets and Wallet Interfaces

User-friendly wallets and payment interfaces are the gateway to mainstream adoption of the Lightning Network. They enable seamless transactions, making LN payments faster, cheaper, and more accessible for everyday use. These wallets cater to a variety of users—from individuals making microtransactions to merchants accepting payments globally.

Over time, Lightning wallets have evolved to offer enhanced security, intuitive interfaces, and integrated services like streaming payments and point-of-sale (POS) solutions.

- Phoenix Wallet (by ACINQ) – Phoenix Wallet offers a self-custodial mobile solution designed for ease of use and instant payments. Its standout feature is automated liquidity management, ensuring that users never have to manually manage channels or worry about network routing.

- Wallet of Satoshi – Wallet of Satoshi is a custodial Lightning wallet that prioritizes simplicity and speed. It’s widely regarded as one of the easiest wallets for beginners, offering a plug-and-play experience without requiring technical knowledge. Although its custodial nature raises concerns for privacy advocates, Wallet of Satoshi remains a go-to option for those looking for speed and simplicity.

- Breez – Breez positions itself as a comprehensive Lightning platform, combining payments, streaming, and merchant tools in a single app. It has gained traction among freelancers, podcasters, and businesses looking to monetize content and services through Lightning-native payments..

- BlueWallet – BlueWallet is a non-custodial wallet known for its focus on security and flexibility. It supports both on-chain Bitcoin transactions and Lightning payments, making it ideal for users who need a hybrid wallet experience.

- Alby Hub, launched recently, is a multi-functional Lightning wallet and payment platform designed to streamline Bitcoin payments, content monetization, and integration with web-based services. It stands out as a developer-friendly tool that supports instant payments and micropayment streaming, making it a powerful solution for both individuals and businesses.

- BitKit, developed by Synonym, is a modular Bitcoin and Lightning wallet designed with a strong emphasis on privacy, decentralization, and user sovereignty. It supports self-custodial storage, enabling users to retain full control over their funds while integrating seamlessly with decentralized identity protocols. With features like contactless payments and encrypted backups, BitKit appeals to users who prioritize security and flexibility. It also includes tools for social recovery and identity management, making it more than just a wallet—it's a personal financial toolkit for the next generation of Lightning users.

Node Management

Running and managing a Lightning Network node is essential for maintaining decentralization, improving network reliability, and enabling businesses and individuals to process payments directly. Node management providers simplify the complexities of setting up and operating Lightning nodes, offering tools that cater to both casual users and enterprise-level operators.

- Eclair by ACINQ is a developer-focused Lightning implementation that doubles as a node management solution. It is optimized for scalability and performance, making it ideal for businesses and services that require high uptime and reliable routing.

- Voltage is a cloud-based node management platform designed for scalability and flexibility, making it particularly appealing for developers and businesses looking to integrate Lightning payments without the hassle of running physical hardware.

- Greenlight by Blockstream introduces a cloud-based approach to node management, combining the convenience of remote hosting with the security of self-custody. Users retain control over their private keys, while the backend infrastructure is managed by Blockstream.

- Nodl offers plug-and-play hardware nodes, making it simple for users to run both Bitcoin full nodes and Lightning nodes at home or in business environments. With a focus on privacy and sovereignty, Nodl caters to users who want to own and control their infrastructure.

- Umbrel is a user-friendly, self-hosted platform that turns any hardware into a personal Bitcoin and Lightning node. Its app-based interface allows users to install additional tools, such as explorers, payment processors, and even media servers, making it more than just a Lightning node manager.

Lightning Network Payment Processors

Payment processors play a pivotal role in the Lightning Network ecosystem by bridging the gap between merchants and consumers, enabling instant and low-cost Bitcoin transactions. These platforms allow businesses to accept payments, convert funds, and manage invoices, making Lightning payments as accessible as traditional payment systems.

Here’s a look at some of the leading Lightning payment processors driving adoption:

- BTCPay Server is a self-hosted, open-source payment processor that gives merchants complete control over their Bitcoin and Lightning transactions. Known for its privacy-first approach, it eliminates intermediaries, enabling businesses to accept payments directly into their wallets.

- LNPay is a developer-focused Lightning payment processor that offers a suite of APIs for integrating Lightning payments into websites, apps, and services. Its emphasis on automation and programmable payments makes it ideal for startups and developers building custom solutions.

- OpenNode is a plug-and-play payment processor built for businesses that want to accept Bitcoin and Lightning payments with minimal setup. It offers conversion services, allowing businesses to automatically convert Bitcoin to fiat currencies, reducing exposure to price volatility.

- Zaprite is a modern invoicing and payment management platform that allows freelancers, businesses, and entrepreneurs to accept Bitcoin and Lightning payments without relying on traditional banking systems. It simplifies invoicing, record-keeping, and tax compliance for Bitcoin-powered businesses.

Financial Services and Neobank

The Lightning Network is not only transforming payments but also reshaping financial services and banking models. A new wave of neobanks and financial platforms built on Lightning technology is offering users faster transactions, lower fees, and borderless access to Bitcoin-based financial services. From peer-to-peer payments to remittances, savings, and spending tools, these platforms make it easier than ever to integrate Bitcoin into everyday financial activities.

Below are some of the most influential Lightning-powered financial services and neobanks driving this evolution:

- Cash App, developed by Block (formerly Square), is one of the most widely used financial apps in the world. It integrates Lightning Network payments, enabling instant and low-cost Bitcoin transfers alongside traditional fiat transactions. Best suited for everyday users looking for a bridge between fiat and Bitcoin with simple payment features.

- Fold combines Bitcoin rewards with everyday spending, making it one of the most popular Bitcoin cashback platforms. Users earn Satoshis (sats)—the smallest unit of Bitcoin—on purchases made with the Fold card, which integrates seamlessly with the Lightning Network.

- Galoy offers open-source banking solutions built specifically for Bitcoin and Lightning payments. It is the technology behind Blink Wallet, a pioneering app that introduced Bitcoin-powered community banking in El Salvador. Galoy’s platform empowers businesses and communities to create Bitcoin-native financial ecosystems.

- Relai App simplifies Bitcoin investing by allowing users to buy, sell, and save Bitcoin without requiring KYC (Know Your Customer) verification. While primarily focused on Bitcoin accumulation, Relai integrates Lightning Network support for fast withdrawals and transactions.

- River Financial is a Bitcoin-focused financial institution offering services like BTC brokerage, wallet management, and node hosting. It emphasizes self-custody options while providing Lightning Network integration for fast, low-cost transfers.

- Strike, founded by Jack Mallers, focuses on instant, global money transfers powered by the Lightning Network. It’s particularly well-known for enabling cross-border remittances without the high fees typically associated with traditional banking systems.

A Thriving Ecosystem

The Lightning Network ecosystem has grown into a vast and interconnected web of services, tools, and platforms, each contributing to the evolution of Bitcoin payments and decentralized finance. While this article highlights many of the key players and projects, it only scratches the surface of what’s out there. The reality is that the Lightning Network continues to expand at a rapid pace, with new tools, apps, and integrations emerging almost daily.

From global exchanges like Binance, Bitfinex, Coinbase, and Kraken enabling Lightning deposits and withdrawals, to social platforms like Orange Pill App and Stacker News fostering community engagement and Bitcoin tipping, the ecosystem is evolving far beyond payments. Rewards platforms and gift card providers such as Bitrefill make it easier than ever to spend Bitcoin instantly, while gaming platforms like ZEBEDEE and THNDR are introducing micropayments and play-to-earn models, redefining the gaming experience.

Despite its impressive growth, the Lightning landscape is still in its early stages, and the map of projects we’ve outlined represents just the tip of the iceberg. As more businesses, developers, and users adopt Lightning, the network is poised to become the backbone of global, decentralized payments. Its ability to support microtransactions, instant remittances, and cross-border commerce is opening doors to entirely new economic models and opportunities that weren’t possible before.

What’s clear is that the Lightning Network is more than just a payment system—it’s a platform for innovation. Among the many innovations shaping this landscape is also Stroom Network, a Bitcoin liquid staking protocol that not only rewards users with Lightning-native yield but also strengthens the network by contributing to its liquidity and scalability. By bridging the gap between yield generation and payment efficiency, Stroom highlights the Lightning Network’s potential to redefine finance, making it more accessible, decentralized, and future-ready.

*****

We trust you've found this article helpful. To learn more about Stroom, access detailed information about our technology, or explore how you can join the ecosystem, visit the following resources:

Official website: https://stroom.network/

Whitepaper: https://stroom.network/Primer.pdf

Twitter (X): https://x.com/StroomNetwork

Discord: https://discord.gg/DZ53WjDXz9

Telegram: https://t.me/stroomnetwork

Stroom DAO

View our other posts

Bitcoin Without Borders: Unlocking Bitcoin's Multi-Chain Potential

Since the birthday of the first Bitcoin block on January 3, 2009, a new era of financial assets has begun - the cryptocurrency era. Unmatched security, permissionlessness, and decentralization cemented Bitcoin'

Stroom DAO

Lightning Network in 2025: Bitcoin’s Transformation into Everyday Money

Bitcoin’s Lightning Network is transforming from an experiment into a global payment system, making everyday transactions faster and cheaper.

Stroom DAO

Lightning Network: Celebrating 9 Years of Innovation

The Lightning Network whitepaper was unveiled on January 14, 2016, introducing a transformative layer atop Bitcoin for instant, scalable transactions.

Stroom DAO