Exploring the Potential of Stroom Tokens

Discover how Stroom Network’s stBTC and bstBTC liquid staking tokens may transform DeFi by enhancing liquidity, lending, and staking protocols.

•

5 min read

The decentralized finance (DeFi) landscape is continuously evolving, with new innovations and protocols enhancing the financial ecosystem. Stroom Network is one of the noteworthy developments in this space, promising to bring new dimensions to liquidity, lending, and staking protocols. In this blog post, we will delve into the potential uses of Stroom tokens and explore how they can transform DeFi experiences for users.

The Current State of the DeFi Space

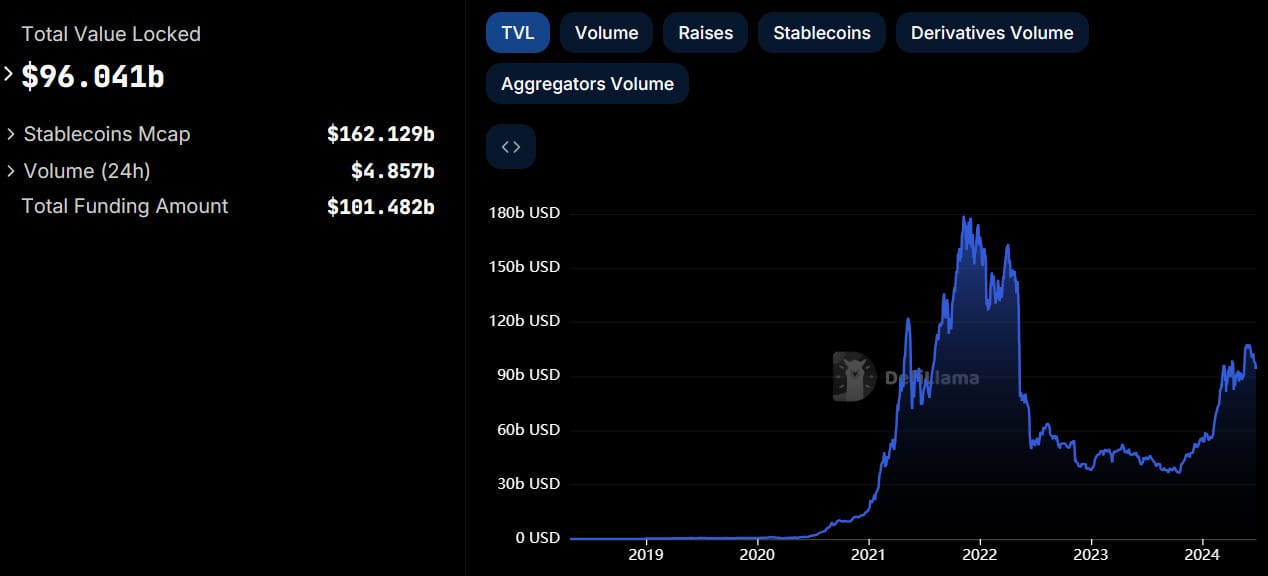

Decentralized finance, or DeFi, has been one of the most transformative trends in the blockchain and cryptocurrency sectors, dramatically reshaping the financial landscape. As of mid-2024, the total value locked (TVL) in DeFi protocols was standing above $95 billion, reflecting the rapid growth and adoption of decentralized financial services. This impressive figure underscores the increasing trust and reliance on DeFi platforms for various financial activities such as lending, borrowing, trading, and earning yields.

The rise of DeFi can be attributed to its ability to provide financial services without intermediaries, offering users more control and transparency over their assets. Platforms like Uniswap, Aave, and Compound have become household names within the crypto community, facilitating millions of transactions and enabling users to earn substantial returns on their digital assets. However, as the DeFi space continues to grow, new innovations and integrations are essential to sustain this momentum and address emerging challenges.

Despite its rapid growth, the DeFi space is not without its hurdles. Security remains a significant concern, with numerous high-profile hacks and exploits highlighting vulnerabilities in smart contracts and protocol designs. Regulatory uncertainty also looms large, as governments and regulatory bodies worldwide grapple with how to oversee this burgeoning sector. Additionally, the user experience can be daunting for newcomers, who may find the technical aspects of DeFi platforms complex and intimidating.

Stroom: Unlocking New Dimensions in DeFi

Imagine being able to earn Bitcoin just by holding onto it, without having to deal with complex setups or locking it away. That’s what Stroom offers. We have developed a groundbreaking Bitcoin liquid staking protocol that lets you stake your Bitcoin and earn native BTC yields through the Lightning Network. By connecting the Lightning Network with Ethereum and other EVM-compatible blockchains, Stroom makes this process smooth and accessible. No need to worry about managing technical infrastructure or losing access to your BTC as it’s you, the user, who keeps control of your funds. Stroom not only makes staking simpler but also helps bring Bitcoin into the broader DeFi world, opening up new opportunities for everyone.

What are stBTC and bonded stBTC (bstBTC)?

At the heart of Stroom’s protocol are two unique liquid staking tokens: stBTC and bonded stBTC (bstBTC). Think of these as liquid versions of Bitcoin that are staked in the Lightning Network, designed to generate native Bitcoin yield in the form of LN routing fees and easily work with the top DeFi platforms – the latter pretty much like how Lido’s stETH is used across various DeFi services.

Both tokens are powerful tools for those aiming to maximize their returns within the Bitcoin ecosystem, offering an extra layer of earning potential. You can switch between stBTC and bstBTC as needed, and both can be converted back to BTC at any time. This flexibility lets you adjust your staking strategy to fit your needs and the current market conditions, ensuring you’re always in control.

stBTC: This token is your gateway to participating in various DeFi activities while keeping your Bitcoin liquid. You can mint stBTC at a 1:1 ratio after depositing BTC to the Stroom treasury and have the freedom to convert it back to the original Bitcoin whenever you want, giving you flexibility and easy access to your assets.

bstBTC: The bonded stBTC token also allows you to earn yields in native Bitcoin, with DeFi integration being optional. This means you can simply enjoy earning your BTC rewards without any additional actions required.

Possible Use Cases of stBTC and bstBTC in DeFi

Stroom’s derivative tokens, stBTC and bstBTC, open up a plethora of opportunities within the DeFi space. Here’s how they can transform various protocols and user experiences:

1. Lending Protocols

One of the primary use cases for stBTC and bstBTC is within lending protocols. By leveraging these tokens, users can:

- Collateralization: Use stBTC or bstBTC as collateral to secure loans on platforms like Aave and Compound. This allows users to access liquidity without having to sell their Bitcoin holdings, thus maintaining their long-term investment positions.

- Earning Yields: Deposit stBTC or bstBTC into lending pools to earn interest. The yields generated from lending activities are in addition to the native Bitcoin yields from staking, effectively compounding returns for users.

2. Liquidity Provision

Another significant use case for stBTC and bstBTC is in providing liquidity on decentralized exchanges (DEXes) such as Uniswap or SushiSwap. This involves:

- Liquidity Pools: Adding stBTC or bstBTC to liquidity pools, facilitating trades and earning a share of the transaction fees. This not only enhances the liquidity of Bitcoin derivatives in the DeFi ecosystem but also provides a steady income stream for liquidity providers.

- Yield Farming: Participating in yield farming initiatives where users can earn additional rewards by staking their stBTC or bstBTC in specific pools.

3. Staking and Yield Optimization

For users looking to maximize their returns, Stroom’s tokens offer unique opportunities:

- Yield Optimization: Utilize platforms like Yearn Finance to optimize the yields on stBTC and bstBTC. These platforms deploy advanced strategies to ensure users earn the highest possible returns on their staked assets.

- Governance Participation: Stake stBTC or bstBTC in governance protocols, allowing users to participate in decision-making processes of various DeFi projects while still earning yields.

4. Restaking for Enhanced Yields

Restaking is an emerging trend in DeFi, where users can stake their staked tokens again to earn additional yields. Stroom tokens are perfectly positioned to take advantage of this:

- Stacking Yields: Users can take their stBTC or bstBTC and restake them on other protocols that offer additional rewards. This allows them to stack multiple layers of yield generation, significantly boosting their overall returns.

- Interoperability: Since Stroom tokens are designed to integrate seamlessly with various DeFi platforms, they can be restaked across different ecosystems, leveraging the best available opportunities for yield enhancement.

Integration into Blue-Chip DeFi Protocols

Stroom is on a mission to make stBTC and bstBTC as essential to DeFi as stETH has become. We’re working to integrate these tokens into the top DeFi platforms, making it easier for you to use your staked Bitcoin across a wide range of applications. This means more opportunities to earn and more ways to make your assets work for you.

By partnering with leading DeFi protocols, we seek to ensure that you can seamlessly tap into the best the ecosystem has to offer, all while keeping your investments flexible and accessible. This approach not only expands how you can use stBTC and bstBTC but also reinforces Stroom's role as a major player in the DeFi world.

Conclusion

With the launch of Stroom and its liquid staking tokens, DeFi gets one notch higher. This way, users earn their native Bitcoin yields without locking their capital or getting into anything that has to do with node infrastructure. This means that the staking experience is made more accessible and better with Stroom. In addition, when stBTC and bstBTC tokens are integrated into lending protocols, liquidity provision, and yield optimization strategies, a whole new dimension of utility and returns can be unlocked for the benefit of DeFi users.

*****

We hope you've found this article helpful. To learn more about Stroom, access detailed information about our technology, or explore how you can join the ecosystem, visit the following resources:

Official website: https://stroom.network/

Whitepaper: https://stroom.network/Primer.pdf

Twitter (X): https://twitter.com/StroomNetwork

Discord: https://discord.gg/DZ53WjDXz9

Telegram: https://t.me/stroomnetwork

Stroom DAO

View our other posts

Mapping the Lightning Network: Node Metrics and Fee Rates

Stroom Network’s latest research reveals key insights into the Lightning Network’s node metrics, focusing on capacity, connectivity, and fee structures for optimized routing.

Stroom DAO

The Future of Bitcoin-Powered Digital Assets - Taproot Assets Explained

Learn how the Taproot Protocol is transforming the Bitcoin blockchain for asset issuance and Lightning Network transactions.

Stroom DAO

Maximizing DeFi Earnings - Liquid (Re)Staking Explained

Discover how liquid staking and restaking can open up new earning opportunities in DeFi and where Stroom's Bitcoin liquid staking offering come into play.

Stroom DAO